B100, the first 100% digital bank that cares for your health and the health of the planet

June 26, 2024

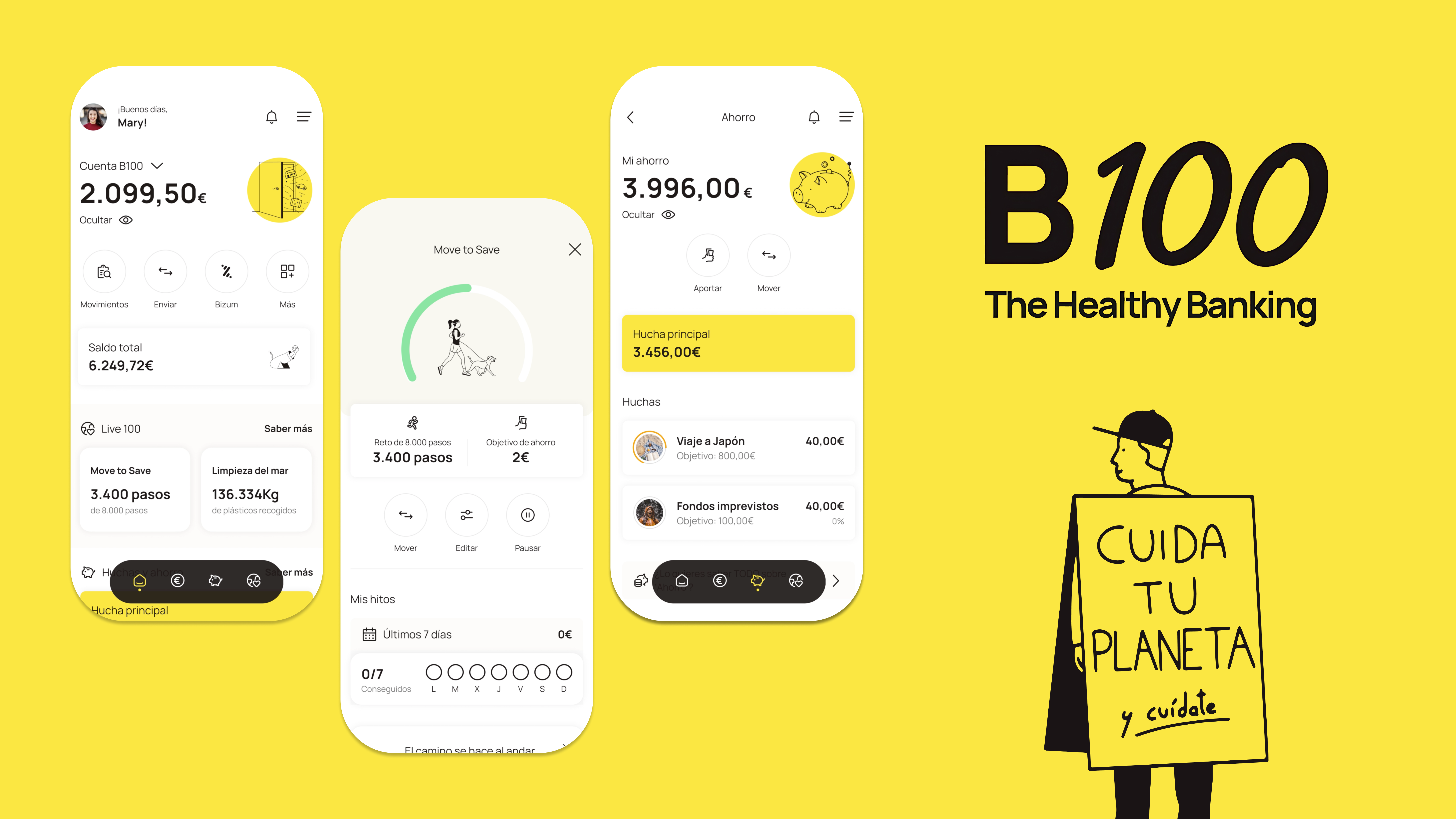

B100 is the new 100% cloud-native bank from ABANCA, launched as an innovative response to the growing need for fully digital financial services. With a unique and differentiating objective, B100 positions itself as Healthy Banking, a concept that encompasses financial, personal, and planetary health.

SNGULAR has worked together on this project as B100's technological and strategic partner, from the ideation phase to the complete development of the digital product, built on Google Cloud. The goal was to offer users a different, sustainable, and technologically advanced banking experience.

Creating a 100% digital bank from scratch is a great challenge, not only because it has to meet current technological expectations, but also because it must anticipate them. This involves providing digital solutions that meet the demands of a constantly evolving market, adapting to consumer behavior and needs, and complying with the strict security requirements of the banking sector. A milestone achieved in record time: in just a year and a half, B100 became a tangible and successful reality.

Why is B100 a Different Bank?

B100 is based on three fundamental pillars: financial health, personal health, and planetary health. As Jorge Mahía, Executive Director of B100, explains, "With B100, we have created a new category of banking, what we call healthy banking, a healthier way to understand the relationship between finances and the health of the planet and people in a balanced way. B100 was born from the very beginning with a purpose: to promote a healthy and sustainable lifestyle."

Financial Health

Regarding financial health, B100 helps its customers save simply and effectively. The B100 account offers solutions such as automatic savings, allowing users to divide their savings into jars for different goals. Users can set up rounding on purchases or periodic transfers to facilitate savings, ensuring their money is always available when needed.

Personal Health

The first personal health product launched by B100 is Move to Save. This innovative service rewards users for meeting daily step challenges by transferring a sum of money to an interest-bearing account called Health. Based on the concept "You move and your money moves," Move to Save promotes physical activity and well-being through a gamified method, encouraging users to take care of their physical and mental health.

Planetary Health

B100 is committed to sustainability through a collaboration with Gravity Wave, a company dedicated to collecting plastics from the sea and ports. With B100's Pay to Save debit card, every payment made contributes to plastic collection. Through the B100 app, users can track the progress of the collected plastics, visualized in grams or equivalent plastic bottles, thus increasing their motivation and understanding of the positive impact.

Building Healthy Banking from 0 to 100 in Record Time with Google Cloud

SNGULAR has supported the B100 team through all phases of the project, achieving the development of a fully functional and advanced 100% digital bank in a year and a half. We participated from the initial concept and ideation, through the definition of functionalities and design, to the architecture and deployment on Google Cloud. Currently, we continue to implement improvements and solutions in data analytics and artificial intelligence to continuously optimize the functionalities and operations of the digital bank, based on detailed analysis of user behavior.

Concept, Research, and Design

B100 started with a clear purpose: to change the paradigm of the banking industry through healthy banking. Creating a sustainable bank requires a detailed understanding of the market, social behavior, and people's motivations. This necessitated defining the concept of sustainability and how to integrate it into an attractive financial proposition for users.

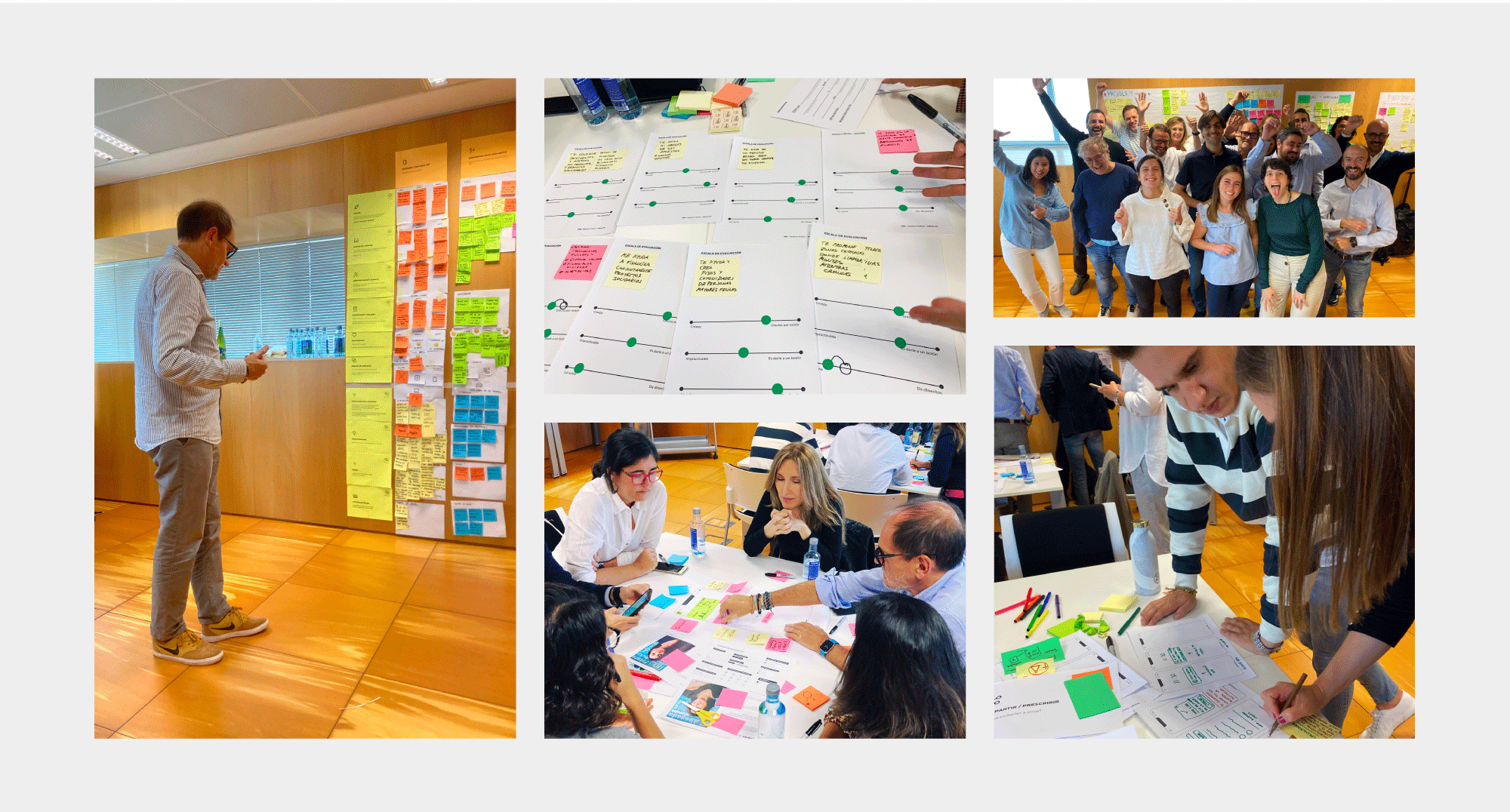

The development began with a deep understanding of the needs and behaviors of potential customers, using a systematic approach of Design Research, which evaluates how these technologies integrate into people's daily lives. The Design Research process followed these phases:

1. Landing and Understanding

For the initial phase, the SNGULAR team focused on understanding who the users of B100 would be and what they value in sustainability. Through thorough research using qualitative and quantitative methods, such as interviews, surveys, and focus groups, four key areas were identified: topics of interest, brand authority, high mobilizing power, and long-lasting care.

2. Ideation, Prototyping, and Validation

With a clear understanding of the potential customer's needs, the ideation phase was tackled. Several prototypes were created and validated through user testing, which allowed the definition of the B100 brand according to four design principles:

- Transparent proactivity: Ensuring that information is easy to understand and accessible, fostering transparency in all actions.

- Active optimism: Communicating social and scientific progress positively, conveying a hopeful message that motivates people.

- Simplicity and effectiveness: Proposing and rewarding positive and feasible actions without pretending to give lessons.

- Design from people's problems: and not from the financial product.

As Sarah Rink, Research Director at SNGULAR, points out, "A key principle was to design from people's problems, not from the financial product. We thought first about people and their social and environmental surroundings to build the best option for a sustainable financial product."

3. Application Definition and Interface Design

With a solid foundation of knowledge and alignment between people's needs and business objectives, the functionalities and interface of B100 were designed with a user-centered approach. This involved various studies with real users to evaluate the effectiveness, simplicity, and usability of the application. The result was an attractive, user-friendly app consistent with the concept of healthy banking, offering all the functionalities of a next-generation digital bank. Additionally, a Design System was created to make the design more sustainable. This was crucial during the application’s construction, as it allowed for the reuse of components and the standardization of the user experience across all digital channels.

Architecture and Development

The primary technological need for B100 was to offer its customers a 100% digital and autonomous banking service, accessible through fully enabled channels for all operations that the customer might need. To meet this challenge, SNGULAR developed two native applications for Android and iOS, and a backend of services in Java running on a Kubernetes cluster, all provided by Google Cloud.

ABANCA's commitment to B100, from the perspective of developing a cloud-native application from scratch, represents not only a competitive advantage but also an imperative necessity to operate in the dynamic digital financial market. With an advanced, robust, and scalable architecture, and an agile and secure development approach, B100 is perfectly positioned to lead the future of healthy banking.

1. Cloud Infrastructure

B100’s infrastructure is based on Google Cloud. As Héctor Javier Hurtado Ruesga, Cloud Engineering Principal at SNGULAR, explains, "The choice of a cloud infrastructure is due to the possibility of obtaining shorter development cycles and thus achieving greater speed in innovation and product iteration. Most of the services we use are directly managed by Google, allowing us to focus on developing functionalities for B100 instead of managing the infrastructure."

2. Security and Compliance

Security has been a priority at B100 from the outset. To address this challenge, the solution implements multiple measures to comply with the strict regulatory requirements of the banking sector, as set by ABANCA.

From the design of all components, security has been a fundamental aspect, ensuring a secure and efficient infrastructure on Google Cloud. In the initial phase, a Landing Zone was developed that includes essential services for domain name resolution, identity and access management, and monitoring and auditing operations.

A completely new identity management based on Cloud Identity was also established to protect user data and banking transactions.

In addition, additional layers of security were added, such as data encryption and two-factor authentication, with regular penetration testing and vulnerability assessments conducted. Secret management and cryptography were handled using KMS and Secrets Manager, and communications were secured through a certification authority.

SNGULAR maintains a strong commitment to code quality and security, deploying all components in Google's Artifact Registry, which includes vulnerability scanning. Security Command Center provides a comprehensive view of security across the organization, identifying vulnerabilities in both software and service configurations.

Google Cloud provides a range of components that have facilitated this comprehensive security approach, ensuring that B100 not only meets regulatory requirements but also offers a secure and reliable experience for its users.

3. Modernizing Banking Technology

Building a 100% digital bank from scratch allows for creating technology on a blank canvas that ensures its evolution in the near future. This means designing and building a secure and adaptable technological infrastructure capable of evolving with market needs and our customers. B100 relies on a microservices architecture, which divides application functionality into small, independent, and self-deployable services. This approach allows for greater flexibility and scalability, as each microservice can be developed, tested, and deployed independently, enhancing development speed and reducing infrastructure costs.

To manage and orchestrate these microservices, Kubernetes is used, automating the deployment, scaling, and management of application containers. Additionally, technologies like Serverless and Cloud Run enable efficient execution of workloads. "This modern, cloud-based approach allows us to adopt an agile development model with rapid iterations and continuous delivery of new functionalities. Unlike many traditional banks limited by monolithic and less scalable technologies, B100 has overcome these challenges thanks to its advanced architecture," adds Héctor Hurtado Ruesga.

4. APIs, Key Piece in Modernization

APIification plays a key role in B100's architecture, allowing microservices to communicate with each other and with other systems through APIs. This approach facilitates integration and the creation of personalized user experiences. To manage these APIs efficiently and securely, we use Apigee, a Google product for creating, publishing, analyzing, and securing these interfaces. This orchestrator enables access control, protects APIs from threats, and ensures optimal performance.

Data and Marketing Analytics

Another key area where SNGULAR has worked on the B100 project is implementing advanced data and marketing analytics solutions. These technologies allow us to better understand user behavior and tailor B100 services to their needs.

1. Understanding the User

Using advanced data and marketing analytics techniques, it's possible to analyze and deeply understand user behavior. This enables us to offer personalized recommendations, whether for saving or investing, based on each client's individual financial behavior.

2. Real-time Integration and Personalization

B100 leverages ABANCA's robust analytics infrastructure, enhancing it with new functionalities. Additionally, by using tools like Adobe Campaign for orchestrating and distributing communications across digital channels and customer service, precise segmentation is facilitated. This enables real-time personalized communications and offers to different audiences.

Furthermore, B100 utilizes a Customer Data Platform (CDP) built on BigQuery to centralize and manage data and communication traceability. This platform facilitates segmentation for sending relevant and personalized messages through multiple channels, significantly enhancing the customer experience.

3. Future Innovations with Generative AI

Currently, the use of generative AI is being explored to further enhance services. The analytics team at B100 is researching how to utilize this technology to process and structure customer service requests, generating personalized and automated responses based on urgency and topic. This innovation will enable B100 to offer a more efficient customer service tailored to the individual needs of each user.

"B100 not only understands its users but also anticipates their needs, offering a truly personalized and advanced experience," says David Lastra, Director of Martech at SNGULAR. "Each interaction becomes an opportunity to provide a personalized and advanced experience," he adds.

Launch and Market Response

User Experience

B100 customers perceive the app as highly usable and visually appealing. The distinctive design is not only beautiful and emotionally resonant but also highly functional. The interface is intuitive, easy to understand, and responds quickly to user actions, ensuring a robust and seamless experience.

Since launch, there have been minimal technical issues, successfully overcoming challenges such as integrations and step counting from multiple devices within the set timeframe. The applications are fast, stable, and enter the market with a level of functionality and robustness that stands out in the industry.

Market Response

The launch of B100 in April 2024 has sparked significant interest and reception from the audience, with features focused on health and savings methods being particularly well-received by users. While it is still early to show detailed usage data, the bank has noticed a growing trend in downloads and a high usage rate, reflecting user satisfaction and enthusiasm.

A Digital Bank Adapted to the Needs of the Changing Market

Thanks to modern cloud technology, B100 can update, correct, and add new functionalities quickly and at a much lower cost. This capability allows for iteration and evolution of the product based on customer needs and behavior. The scalability of its infrastructure, which facilitates ongoing innovation and improvement, positions B100 as leaders in digital banking and pioneers in the healthy banking category.

Next Steps for B100

B100's next steps focus on two main aspects. In the short term, further improving the usability of the application to ensure it is extremely simple, attractive, and robust. Additionally, as mentioned earlier, another improvement proposal focuses on implementing generative artificial intelligence to process customer service requests more efficiently, generating personalized responses automatically.

Looking towards the long term future, B100 aims to expand the range of functionalities and products, providing customers with more tools and options to manage their finances in a healthy and sustainable manner.

SNGULAR and B100: A Journey Towards Sustainable Innovation

Between B100, ABANCA, Google, and SNGULAR, a perfectly aligned team has been created, with transparent communication and full engagement in the project.

Jorge Mahía emphasizes: "To carry out B100, we didn't just need a technology provider, but a strategic partner. We were looking for a committed team that understood and shared our purpose from the outset, someone willing to share our joys, concerns, and challenges. The distinction between a mere technology provider and a strategic partner lies in their level of genuine involvement in the project. With SNGULAR, we have found that great ally."

A fundamental aspect that has united us with B100 from the beginning is the shared vision of contributing to a more sustainable world through digital solutions that benefit both businesses and the planet. SNGULAR's mission is to support our clients in assessing and enhancing the positive impact of their projects, promoting responsible digital awareness. This commitment to sustainability and innovation allows us to create solutions that not only improve business efficiency but also promote a greener and more conscientious future.

In conclusion, ABANCA's commitment to a more innovative and sustainable approach, based on the concept of healthy banking, has proven to be a highly successful choice. This has strengthened its position as a leader in the financial industry and has opened new perspectives for a more sustainable future.

At SNGULAR, we are fully committed to accompanying you on the journey towards modernization. We have extensive experience in both the banking sector and complex application modernization projects, whether through migrations or developing from scratch in cloud-native environments across various industries.

If you're ready to take the step towards modernization to grow your business, we invite you to get in touch with us. Our team is prepared to analyze your project in detail and collaborate with you on developing modern, secure, and scalable digital solutions that perfectly fit your needs. Together, we can build a more innovative and sustainable future. We look forward to the opportunity to collaborate with you!