Transforming digital payments through a collection application from a leading international bank

November 27, 2023

In 2017, SNGULAR initiated a new project in the solutions area of payments for one of their most stand out clients in the sector: a leading global bank in the financial services that had already shared a successful track record, having collaborated extensively in the past on a diverse array of projects.

This institution was looking to completely redefine the payment experience from mobile devices trying to bring it to a superior technological level, while also exploring new horizons.

According to Luis Reja, Project Manager and Mobile DEvelopment at SNGULAR, "This project represents an unique opportunity for fusing the banking experience. As we worked arm and arm with the client, we weren’t only improving the existing application, but actually we created a solution that defines the future of mobile transactions in the financial industry and it is a step towards a digital banking futuro".

The Bank Leading the Mobile POS Payment Strategy

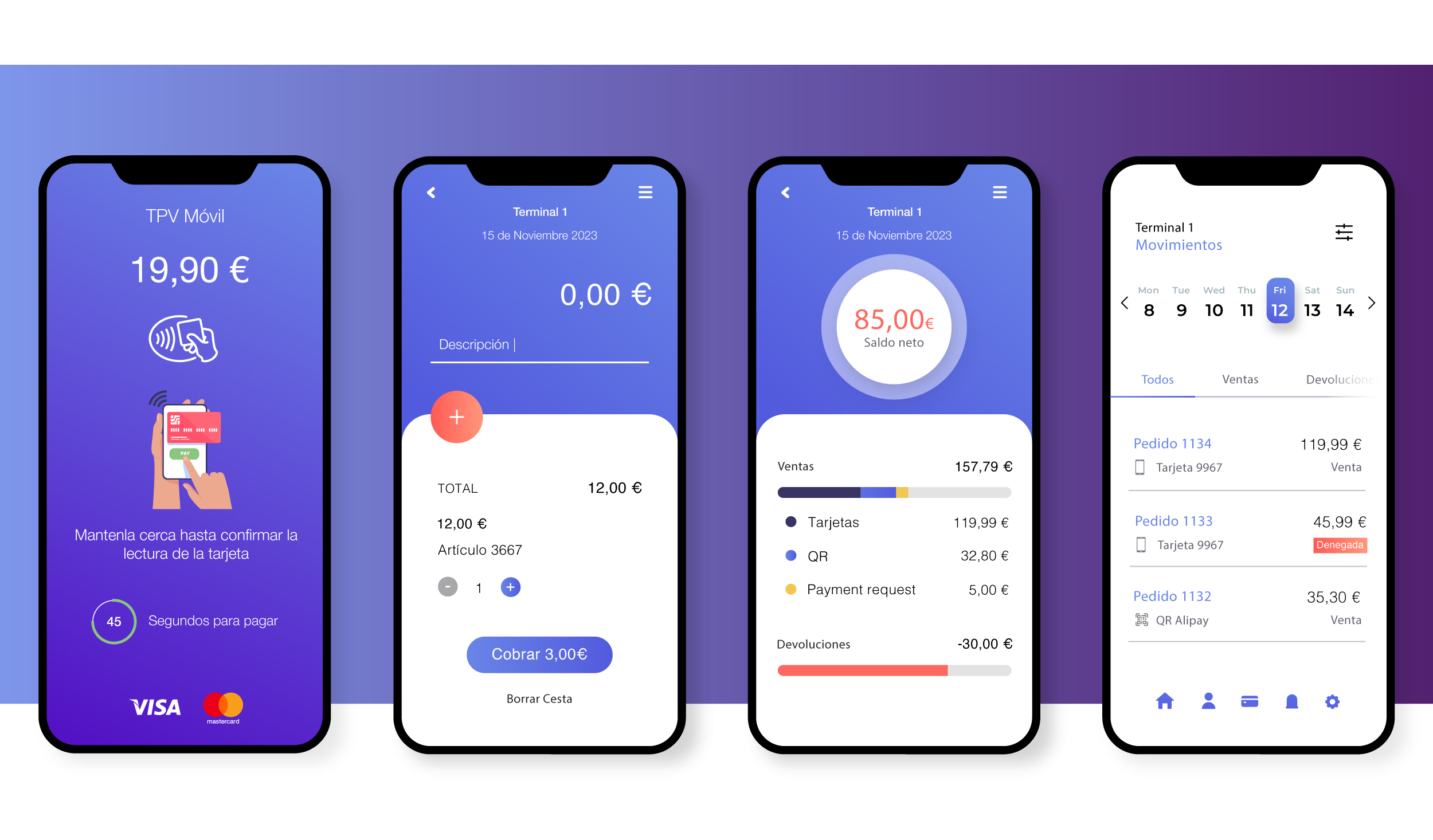

Mobile payment has become the standard for both online and offline transactions. In response to this evolution, our client introduced the Mobile POS Payment Terminal, marking a significant milestone in the evolution of financial services.

When SNGULAR joined this project, it encountered a pilot program that involved replacing conventional point-of-sale terminals with mobile payment options. Through the bank's payment application and a PIN pad terminal, operators could securely and considerably more conveniently conduct transactions using their mobile devices.

In the words of Luis Miguel Reja, "Since the beginning of our involvement in this project, the application presented undeniable potential. The liberation of operators from dependence on bulky physical devices, previously indispensable for these operations, has been a major breakthrough. This change not only simplifies the purchasing experience but also eliminates significant constraints, enabling a more agile and efficient service".

The Integration of Tap on Phone: A Step Further in Mobile Payment Innovation

In its quest to enhance the mobile payment experience, SNGULAR has successfully integrated a series of existing technologies in the sector, surpassing the high complexity of the process and its demanding requirements to develop and support one of the standout features of the project: Tap on Phone.

This system eliminates the need for a PIN pad, allowing users to make payments easily and securely by simply tapping their card or device directly on the merchant's mobile phone. Following successful trials in over 300 businesses, this solution marks a turning point in the conception of mobile transactions.

The elimination of additional hardware is a standout feature of Tap on Phone, opening new possibilities for merchants and independent professionals who are no longer restricted to a fixed location or a conventional POS reader. Payments can be processed from anywhere the collector carries their mobile phone, providing businesses with more flexibility and mobility.

With this functionality, entrepreneurs have the ability to turn their smartphones into secure devices for accepting card payments and other transactions, eliminating the need for additional equipment and avoiding setup costs. Additionally, the company can exercise full control over its collections and efficiently manage refunds in real-time directly from the application.

The implementation process is as straightforward as installing the payment app on a smartphone and accessing it with a password to initiate the process. For each transaction, the amount and payment method are entered into the application. By bringing the customer's card or mobile device close to the phone, the operation is processed quickly and completely securely.

The application is compatible with various forms of payment, including chip cards, contactless payments, magnetic stripe, and NFC on mobiles from major Spanish and international payment networks. This ensures broad acceptance and allows users to choose the payment method that suits them best.

Furthermore, the digital payment receipt functionality eliminates the need for a physical printer, facilitating the transition to a completely digital and sustainable payment process.

What about security?

At SNGULAR, we recognize that security in mobile payments is a critical element that defines user trust and the integrity of financial transactions. We conduct continuous risk assessments and implement advanced real-time monitoring and pattern analysis systems to combat fraud, providing an additional layer of protection to our users.

From the early stages of the project, we strictly adhere to rigorous security protocols and collaborate with third-party software to anticipate and mitigate potential emerging risks. We strive to establish exceptional security standards from our specialized Payments area.

Through the client's payment application, we ensure maximum protection in handling financial information, as it relies on all layers of security incorporated by the financial software platforms it integrates. In this context, it is essential to highlight that the merchant's phone responsible for processing the payment never stores customer card data, and access to such data is never allowed.

Furthermore, in the fight against fraud, this solution facilitates the integrated technology from the bank, sourced from third-party providers, to operate harmoniously and compatibly, aiding in the implementation of advanced real-time monitoring and pattern analysis systems. This capability allows us to identify potential illicit activities, providing an additional layer of protection to users and ensuring the integrity of their mobile transactions.

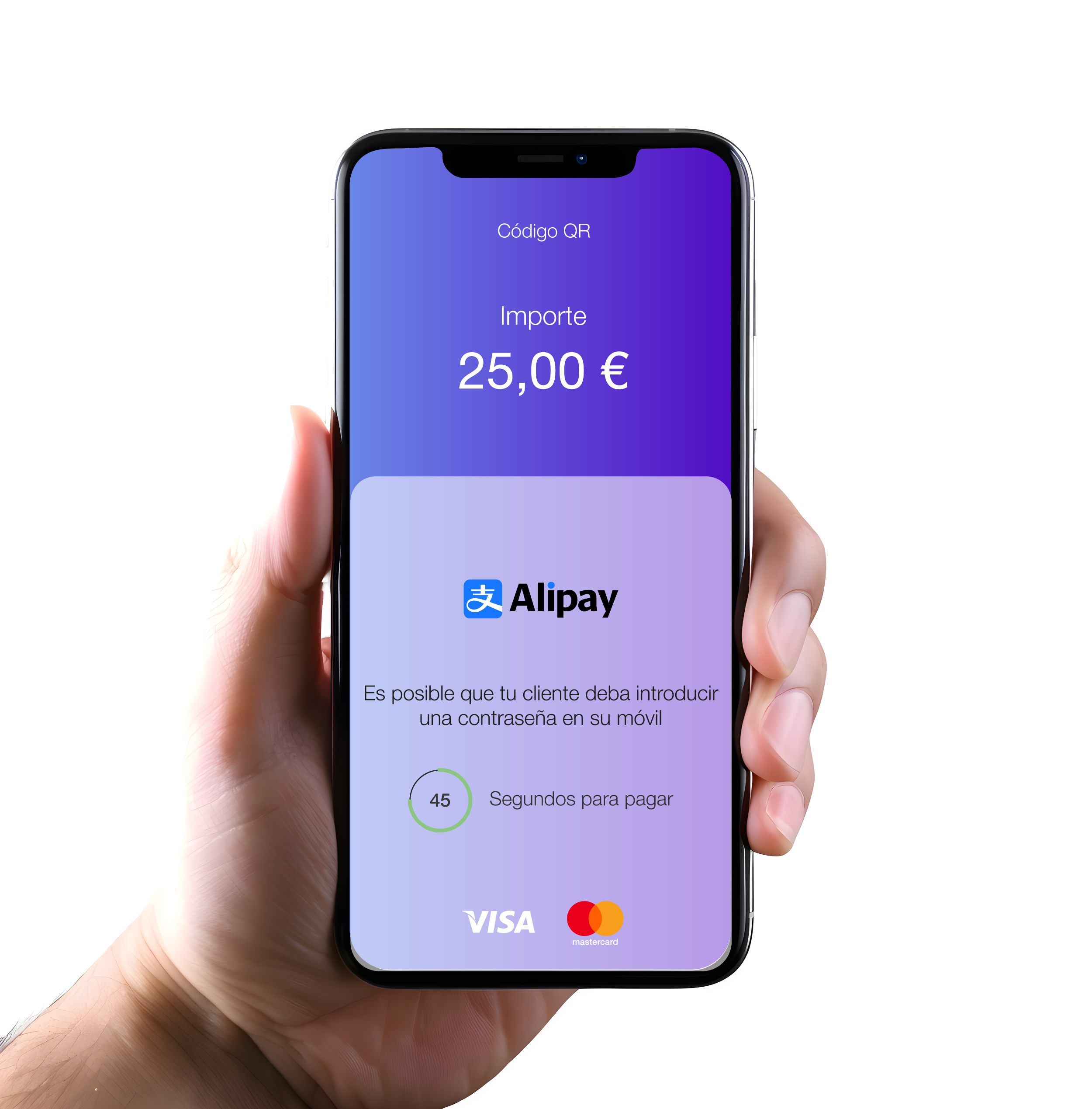

Integration with Alipay and WeChat

One of the functionalities we developed within the payment application was the integration with QR code payments from WeChat Pay and AliPay, which we later incorporated into Tap on Phone.

This strategic integration with AliPay, the leading online payment platform in China, and WeChat, a messaging application that has evolved to include payment functions, represents a significant step in expanding the capabilities of the application.

Beyond opening new possibilities for local users, it aims to address the specific needs of the growing Chinese community in Spain. Facilitating transactions for this community not only contributes to improving the shopping experience for Chinese tourists in the country but also strengthens the bank's international connection.

Alipay, owned by the Alibaba Group, is a leading payment platform in China, and its integration with the banking application allows for a smoother and more convenient connection for those familiar with this payment app in their home country. On the other hand, WeChat, known for its dominance in digital communication in China, has become an integral tool for daily transactions, and its inclusion in our client's application opens a wide range of possibilities for local users and tourists alike.

Luis Miguel Reja emphasizes, "This strategic integration not only optimizes accessibility and convenience for users but also solidifies the application as the preferred choice for the Chinese community, enhancing the shopping experience and strengthening the bank's international presence. With this initiative, we not only expand the capabilities of the application but also reinforce its position as a leader in global digital financial solutions".

Exponential Success: The Mobile Payment POS Revolution

With an adoption rate exceeding 20,000 users in the last month and an impressive surge of 600 new users per minute, the application has not only gained traction but has emerged as the paradigm for user preferences in mobile payments. This pronounced trend not only signifies a fundamental transition but also indicates the rapid transformation of the mobile payments landscape, with the Mobile Payment POS noticeably displacing conventional POS terminals.

With extensive industry experience, SNGULAR solidifies itself as a key strategic partner for the global bank, providing comprehensive solutions across all payment channels, from gateways to electronic payment terminals. With a team of multidisciplinary professionals, SNGULAR's payments team offers end-to-end capabilities, enabling businesses to provide a wide variety of alternative delivery channels and continually enhance the customer experience.

As highlighted by Luis Miguel Reja, "The partnership between the top-tier bank and SNGULAR has not only driven substantial technological progress but has also set the stage for future innovations in the worldwide financial sector".

Our latest news

Interested in learning more about how we are constantly adapting to the new digital frontier?

Insight

September 9, 2025

From Cost Center to Competitive Advantage: Discover the New ROI of Customer Service

Insight

July 29, 2025

The Cybersecurity Value Chain: From Strategy to Control

Insight

July 15, 2025

Elevating Customer Experience: The Vital Integration of Customer Service, Marketing, and Sales

Insight

June 10, 2025

Why Customer Service will be your main competitive advantage in the next two years